EveryPay Pricing Policy

Our fees are per successful transaction.

In case of cancellation or refund, our commission is also refunded.

|

No hidden costs.

No monthly or annual subscription.

Free registration to the Everypay system

Free Plug -in or APIs to interface with the Everypay platform

Zero API connection cost

Free access and use of the Everypay dashboard

EveryPay’ s Pricing Policy is based on the interchange ++ model.

What is Interchange ++?

The Interchange Fees EC Regulation 2015/751 has been published on May 19, 2015 and entered into force on June 8, 2015. This Regulation imposed important changes regarding card-based payment transactions, such as the pricing mechanisms and the costs associated with card payments.

Interchange++ is a pricing model widely implemented in Europe and the N. America for any Visa and Mastercard payments. The advantage of this pricing model is the complete analysis of the costs involved in a card transaction.

What is included in the Interchange++ pricing model?

The Interchange++ pricing model will charge each merchant for each card transaction the total sum of the following cost categories:

· The interchange fees

· The scheme fees

· The acquirer fees

The following is an explanation of the above cost categories:

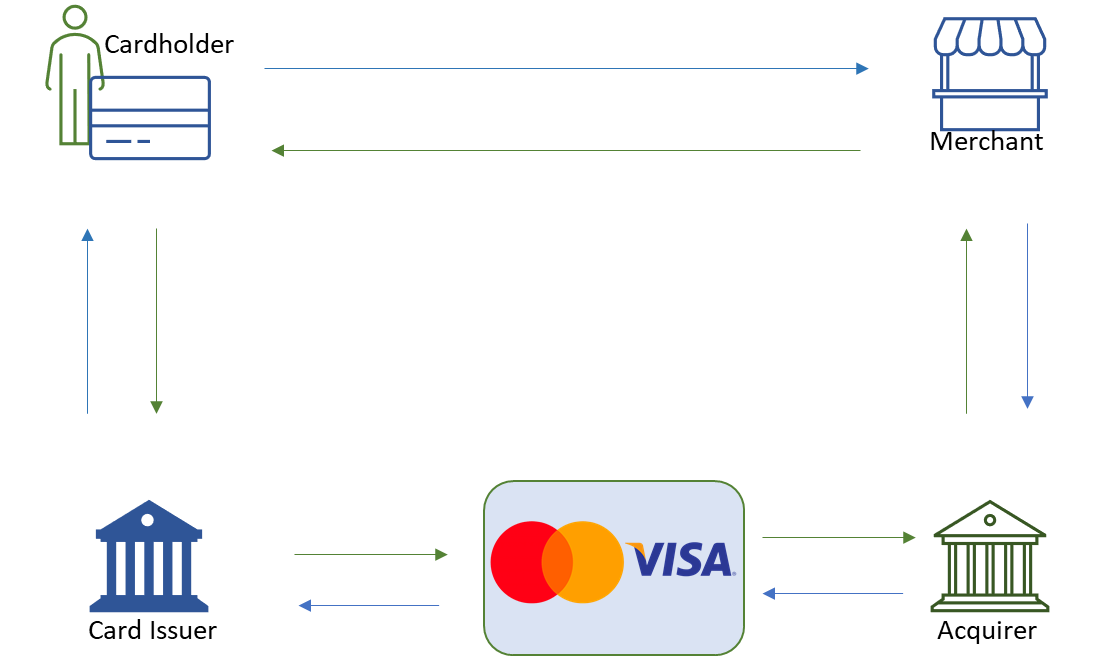

Interchange fees

Each time a consumer uses a (debit/ credit) card to buy something, the acquirer pays a fee called 'interchange fee' to the issuer.

Scheme fees

Scheme fees are unregulated costs imposed by card schemes such as Visa, Mastercard.

Acquirer fees

The acquirer fees are determined by Everypay, considering your estimated GMV for card not present transactions, your average ticket, and the MCC (Merchant Category Code).

The exact size of the interchange and scheme fees depends on several factors. The Interchange fee may vary depending on the type of card and the issuer's country of operation. For example, it may start from 0,2% for EU issued consumer cards and may reach up to 2%. Scheme fees start from 0,10% per transaction for physical POS and can go up to 0,65% for E-Commerce or MO/TO transactions.

The fees described above are listed in greater detail and analysis on the websites of Visa and Mastercard.

EveryPay’s Pricing Policy

Card Not Present (eCommerce) | ||

|---|---|---|

Card Type | Percentage | Flat Fee |

Visa - MasterCard - Maestro (inside E.U. Personal) | 1,40% | 0,12€ |

Visa - MasterCard - Maestro (inside E.U. Business) | 2,95% | 0,12€ |

Visa - MasterCard - Maestro (outside E.U. Personal) | 2,95% | 0,22€ |

Visa - MasterCard - Maestro (outside E.U. Business) | 3,95% | 0,22€ |

Diners - Discover | 3,10% | 0,12€ |

Virtual Cards (inside E.U.)* | 1,40% | 0,12€ |

Virtual Cards (outside E.U.)* | 3,95% | 0,12€ |

IRIS payment | 0,55% | |

Dispute transaction cost | 25€ | |

Clearing Cost: To systemic banks | Free of Charge | |

Card Present (Physical POS & Soft POS) | ||

|---|---|---|

Card Type | Percentage | Flat Fee |

Visa - MasterCard - Maestro (inside E.U.) | 1,30% | 0,14€ |

Visa - MasterCard - Maestro (outside E.U.) | 2,80% | 0,14€ |

Visa - MasterCard - Maestro (inside E.U. Business) | 2,20% | 0,14€ |

Visa - MasterCard - Maestro (outside E.U. Business) | 2,80% | 0,14€ |

IRIS payment | 0,55% | |

Dispute transaction cost | 25€ | |

Clearing Cost: To systemic banks | Free of Charge | |

Cost of acquiring a physical terminal | 270€ + VAT | |

Annual subscription for a physical terminal | 50€ + VAT | |

Cost of acquiring Soft POS application | Free of Charge | |

Soft POS monthly subscription | 5,5€ + VAT | |

*EveryPay’s fee is up to this rate. You may pay less than this rate depending on parameters such as card type, and jurisdiction. Interchange and Scheme Fees are separate and unrelated with EveryPay’s fee and can vary depending on the card type, jurisdiction, and other parameters not controlled by EveryPay.

Additional Costs | |

Cost of failed Transaction | Free of Charge |

Cost of Refunds | Free of Charge |

Cost of Cancellation of Transaction | Free of Charge |

Cost of Settlement (transfer to Bank Account) | Free of Charge for all Greek Systemic Banks |

Registration to EveryPay’s System | Free of Charge |

Cost of API Connection | Free of Charge |

Cost of Plug-in or API required for the connection to EveryPay’s Platform | Free of Charge |

Cost of Account Setup | Free of Charge |

Use of EveryPay’s Platform (Dashboard) | Free of Charge |

Chargeback fee | 25€ |

We offer

✓Transactions without redirection. The customer completes the transaction in no time.

✓No additional clearing costs towards all systemic banks (Piraeus, Alpha, Ethniki, Eurobank).

✓No additional fees for cancelled, failed, or returned transactions.

✓The most advanced E-Commerce system in Greece (99,9% uptime) for E-shop card payments.

✓Failover Transaction System (increase of successful transactions).

✓Electronic POS and Virtual POS.

✓Fraud Protection Tools, KYC & AML checks for individuals and businesses.

✓Support of Interest free payments.

✓Preauthorization of Payments.

✓Free registration to EveryPay’s platform.

✓No additional API connection charges.

✓Tokenization technology, providing your business the opportunity to receive payments, efficiently and effectively.

✓Zero cost plug-in for EveryPay’s interface.

✓Free use of EveryPay’s platform (Dashboard).

✓Account activation in EveryPay’s System, so you can receive direct customer payments.

✓One Click Refunds/ Cancellations from the Dashboard.

✓Commission for every successful transaction.

✓9 ready-to-use plugins for popular web site development.

✓Instant Report. Easy and quick reports for your business just as accounting.

✓ Analytics & Insights. Analyse your data and increase your sales.

✓ Email Payment notifications can be utilized by clients instead of a physical POS.

✓ Unique solutions for Online Marketplaces.

![]()